My own analysis of The Inner Circle Traders work to help improve my trading.

The breaker is a concept taught by ICT. After my own analysis this is my break down of a recent trade and a series of events that occur leading up to the trade and when it is right to enter. This is only initial observations and may prove to be incorrect after longer analysis. I am also explaining why I think what happens at each stage does. I find if there is a logical reason for something happening then you believe and ultimately trust in it more. Also, the more confluences the better.

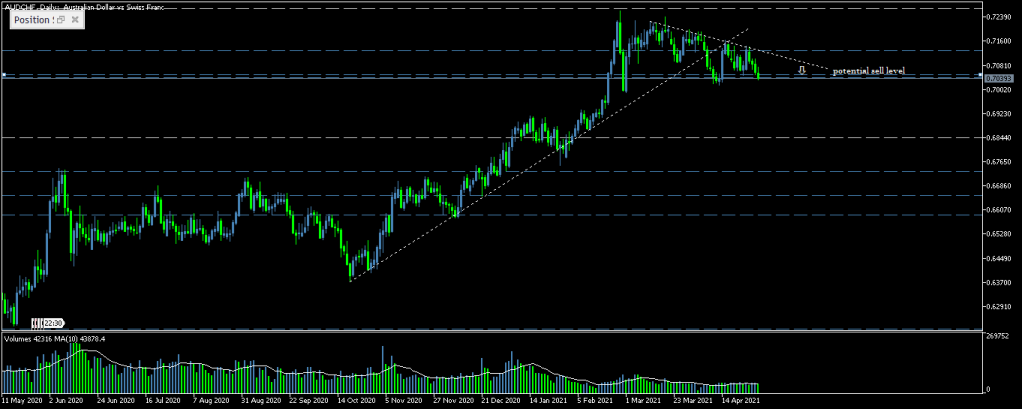

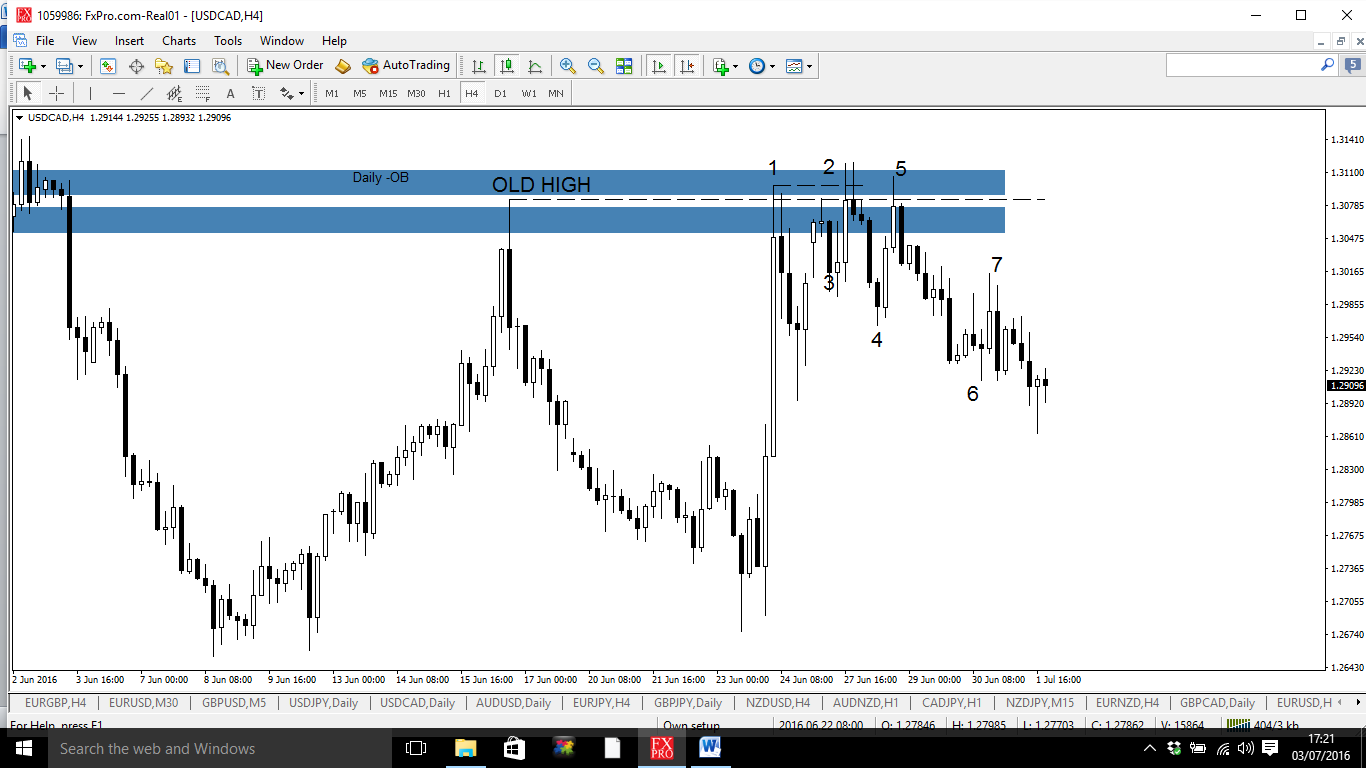

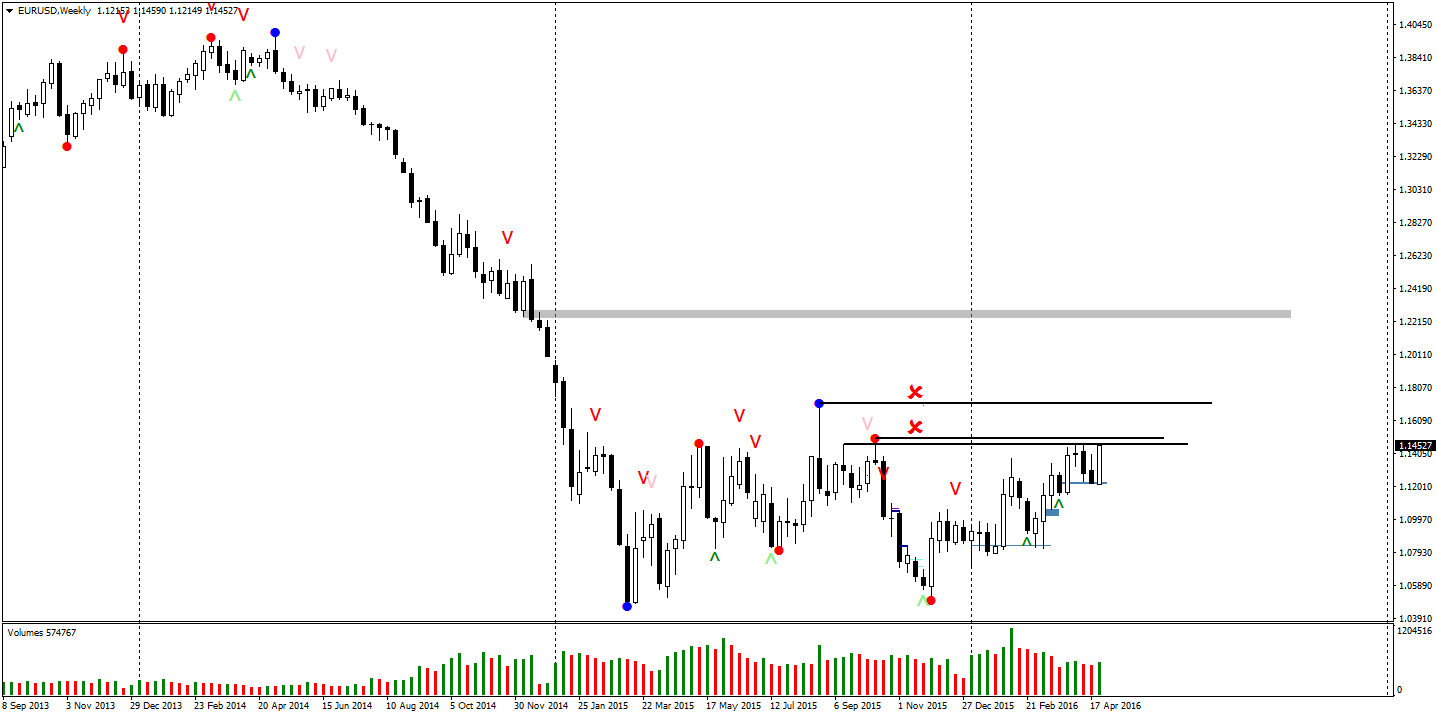

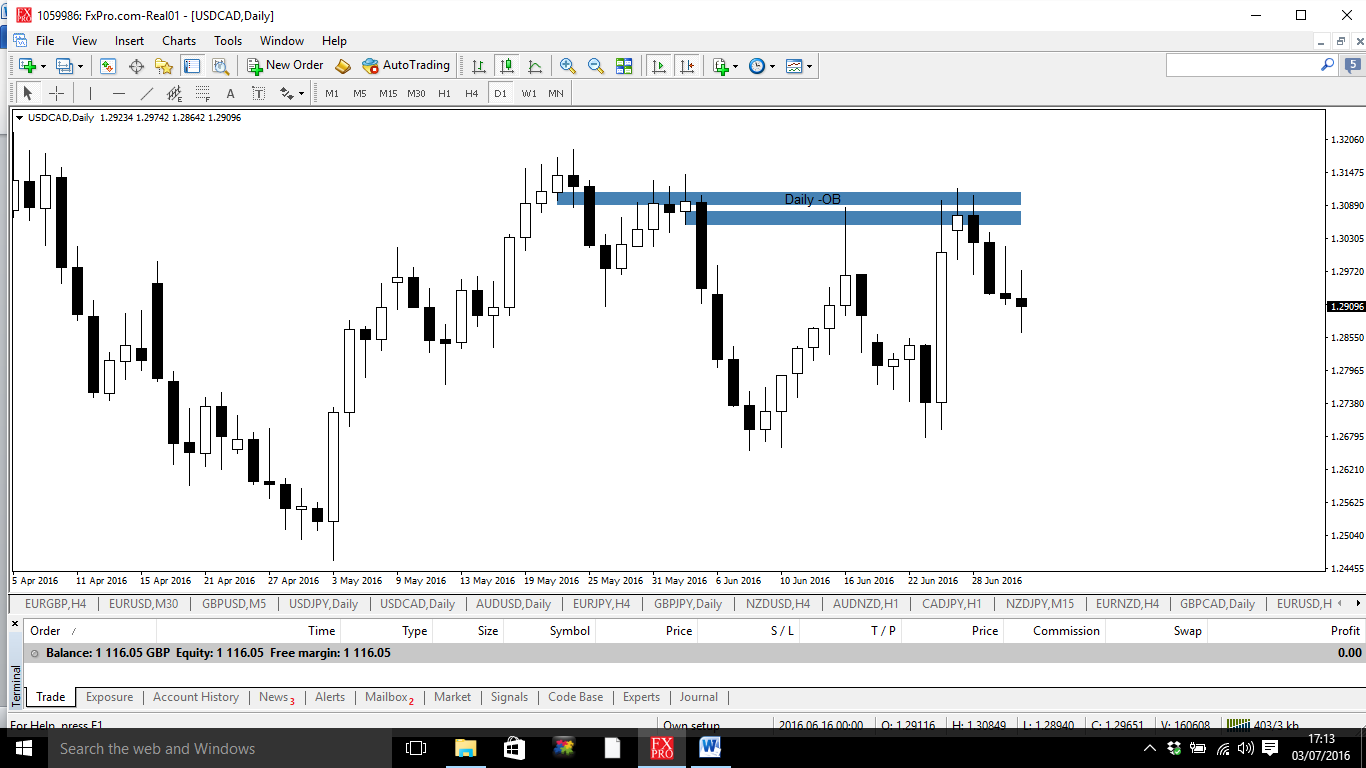

I will be looking at the USD/CAD from last week.

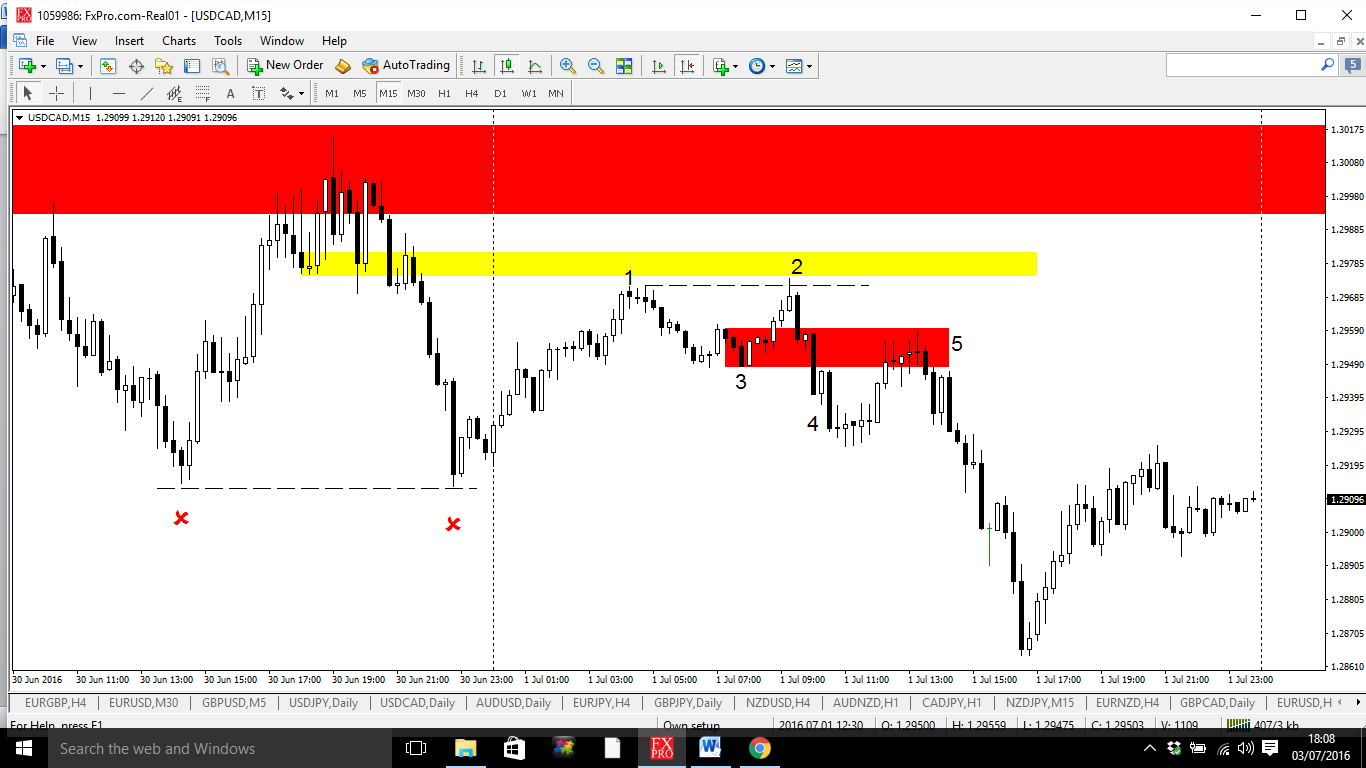

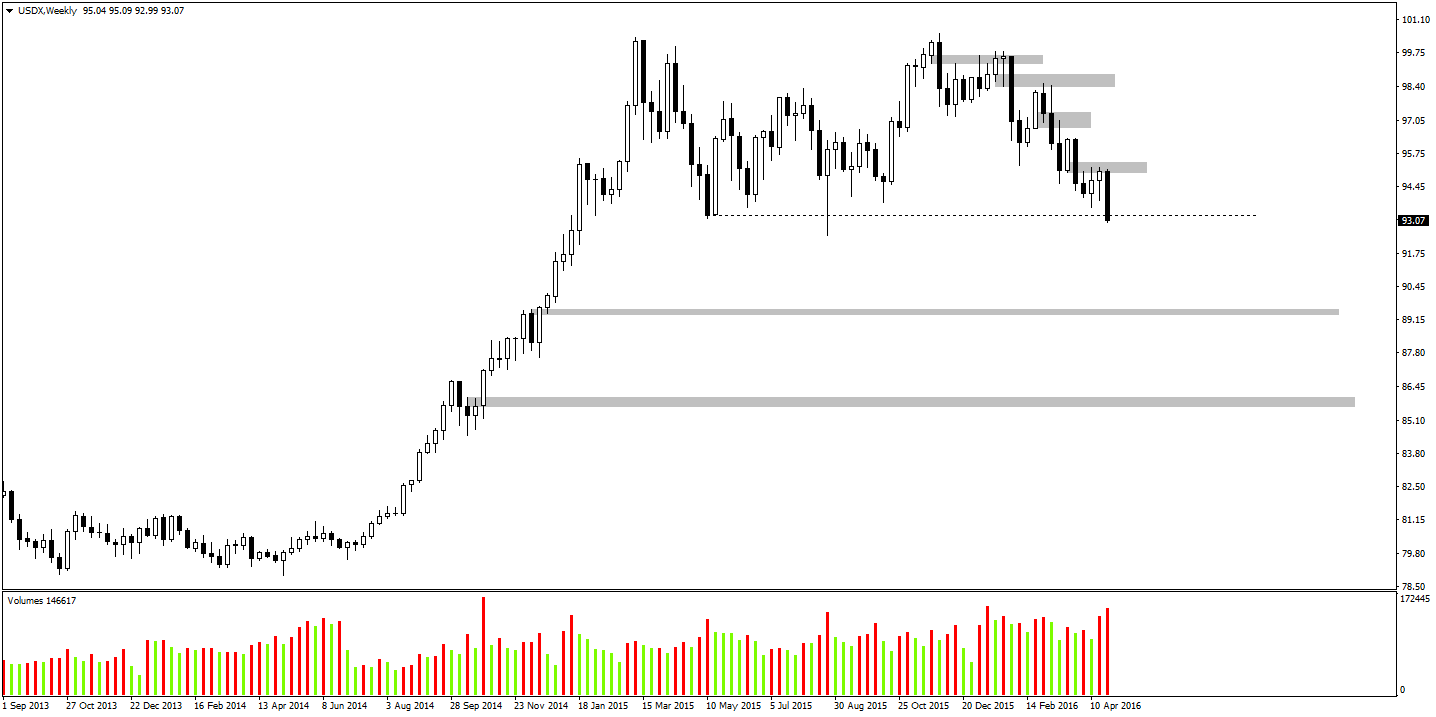

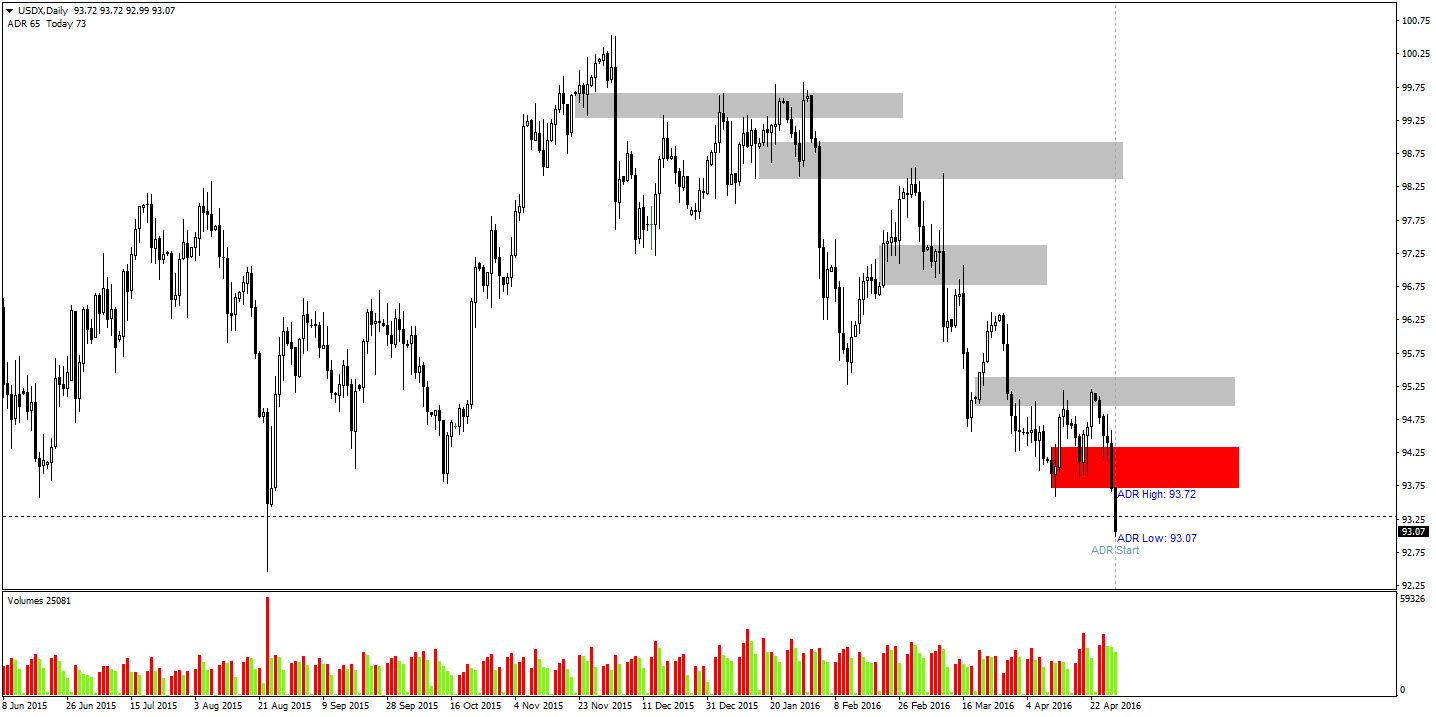

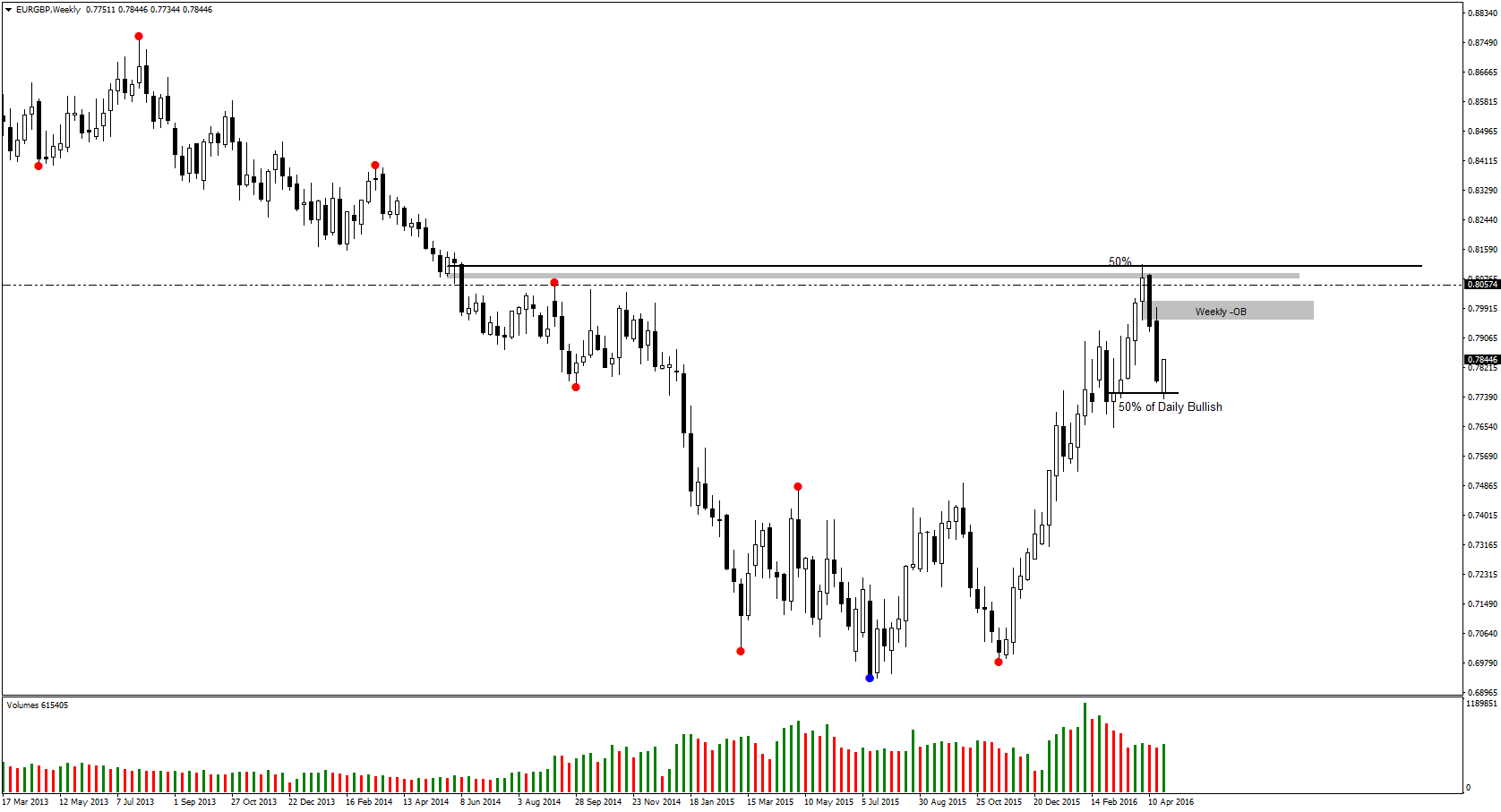

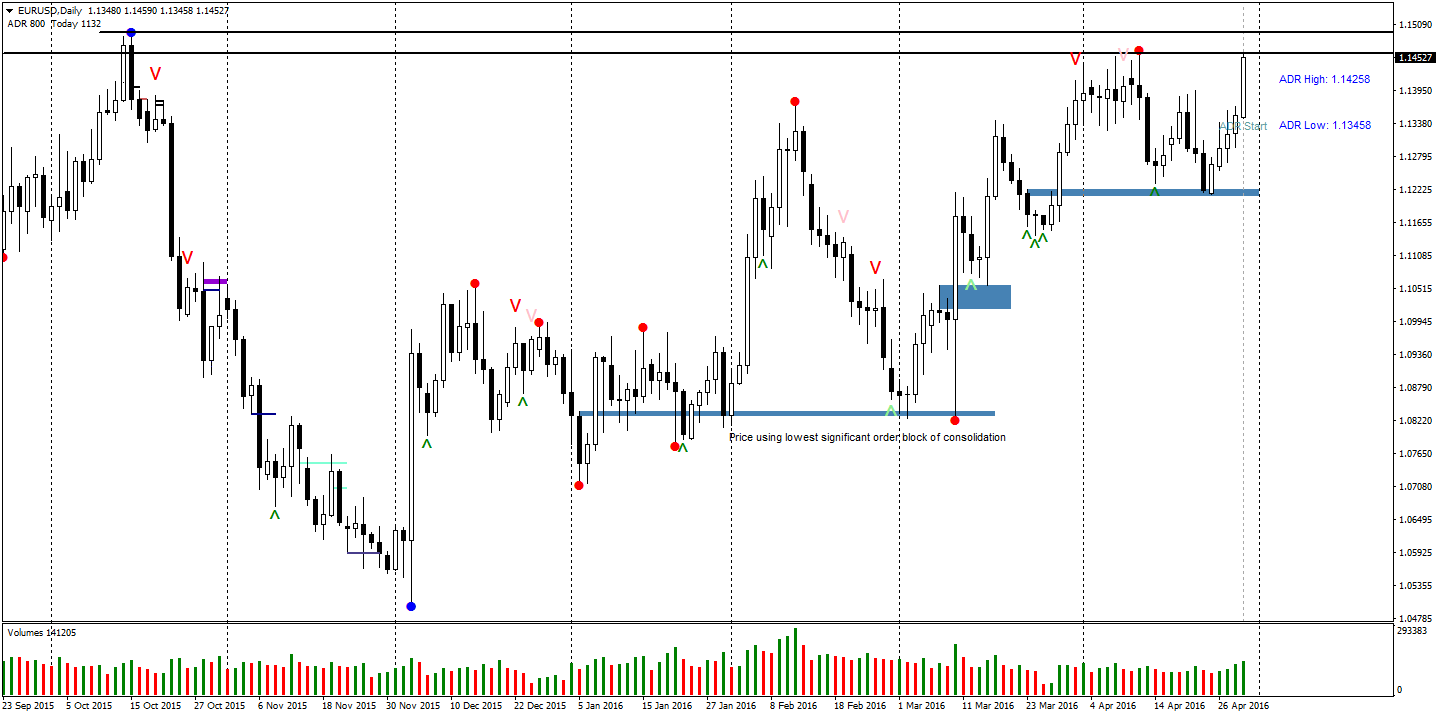

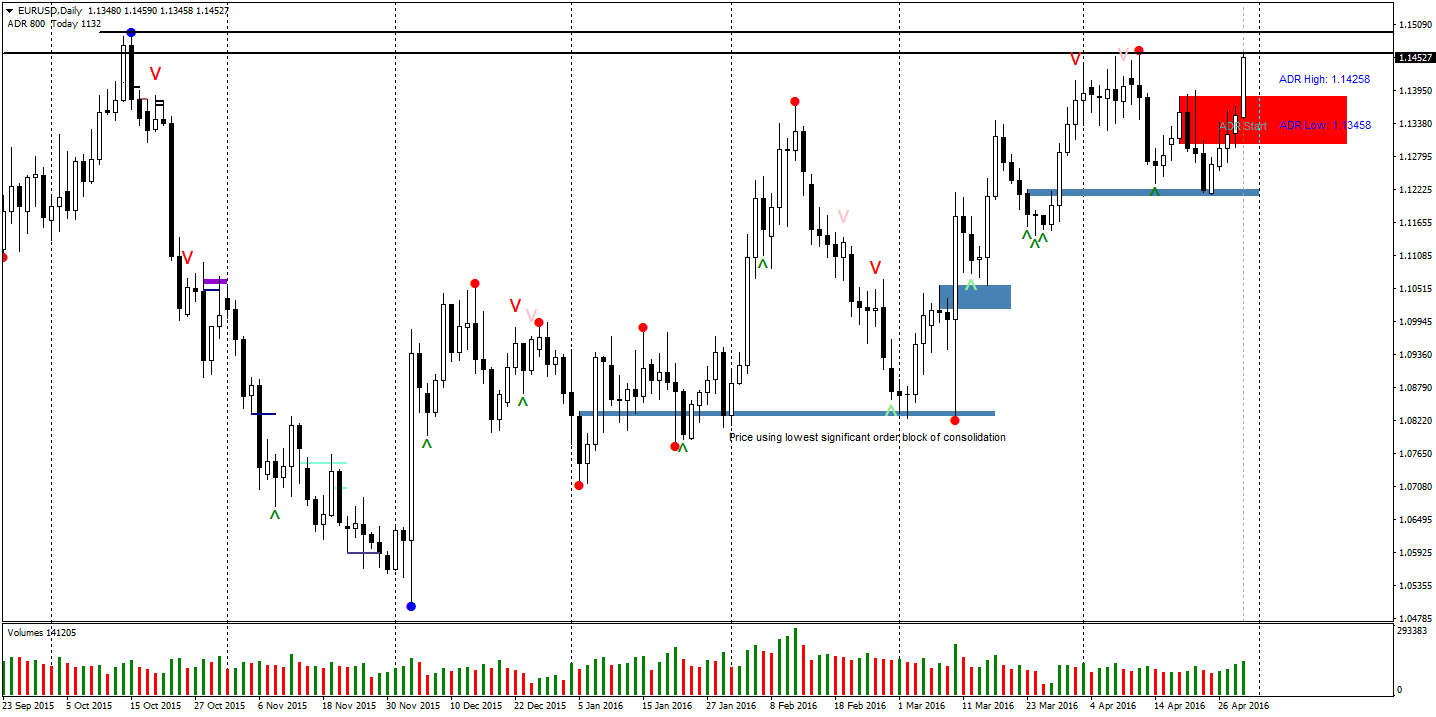

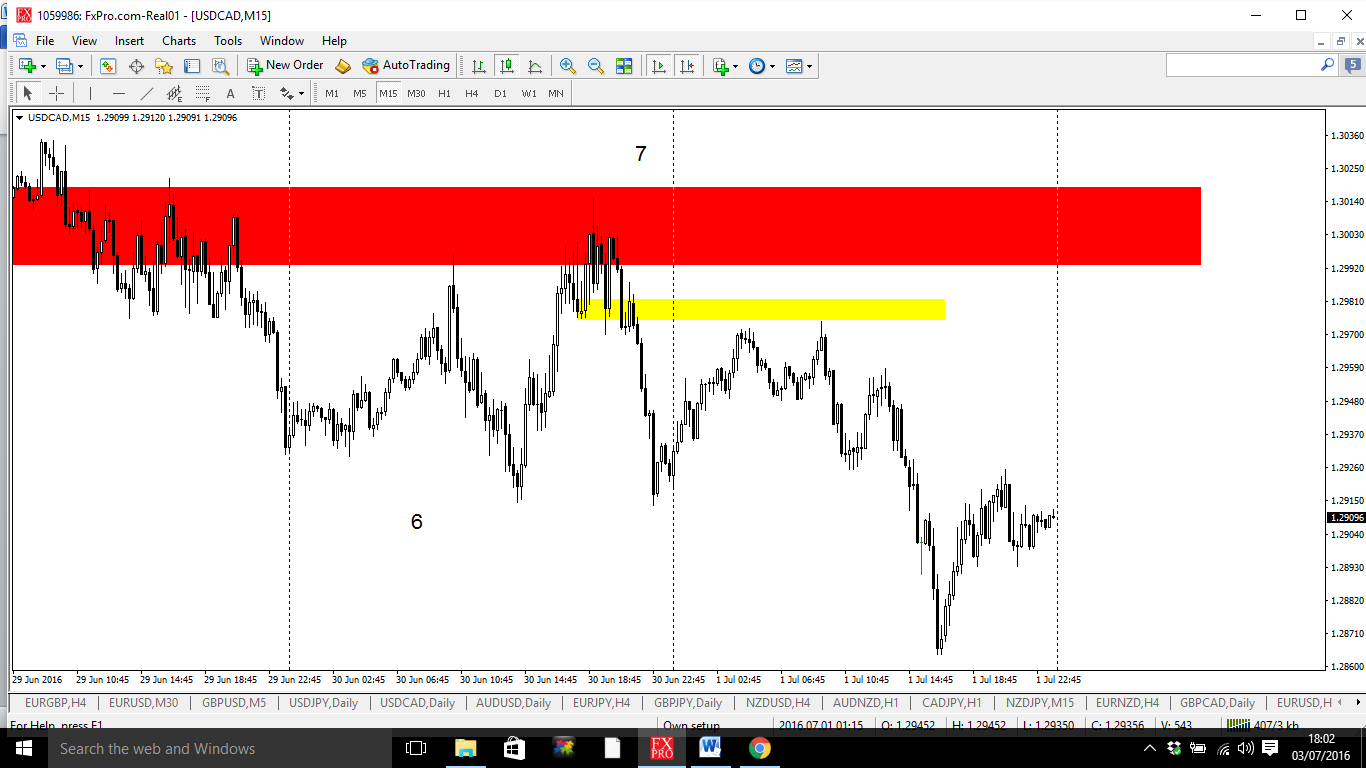

Price was running up into two bearish daily order blocks so the expectation was for some reaction within this area.

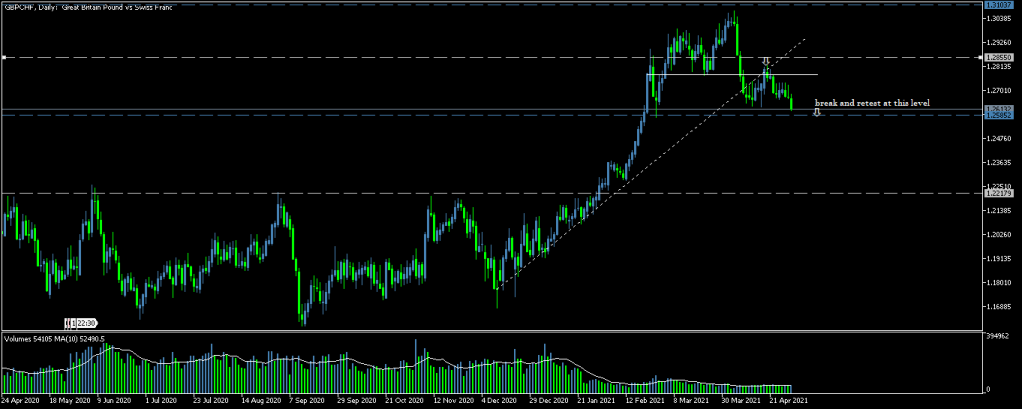

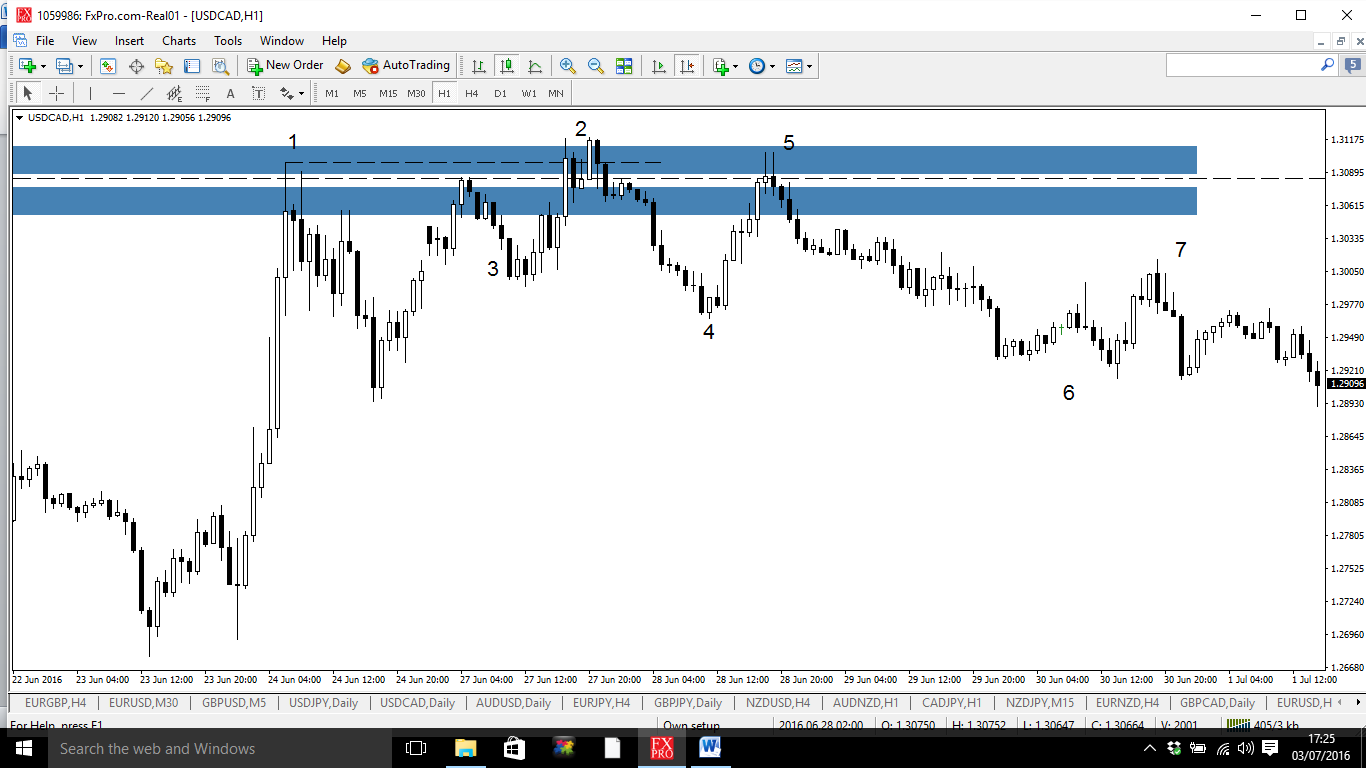

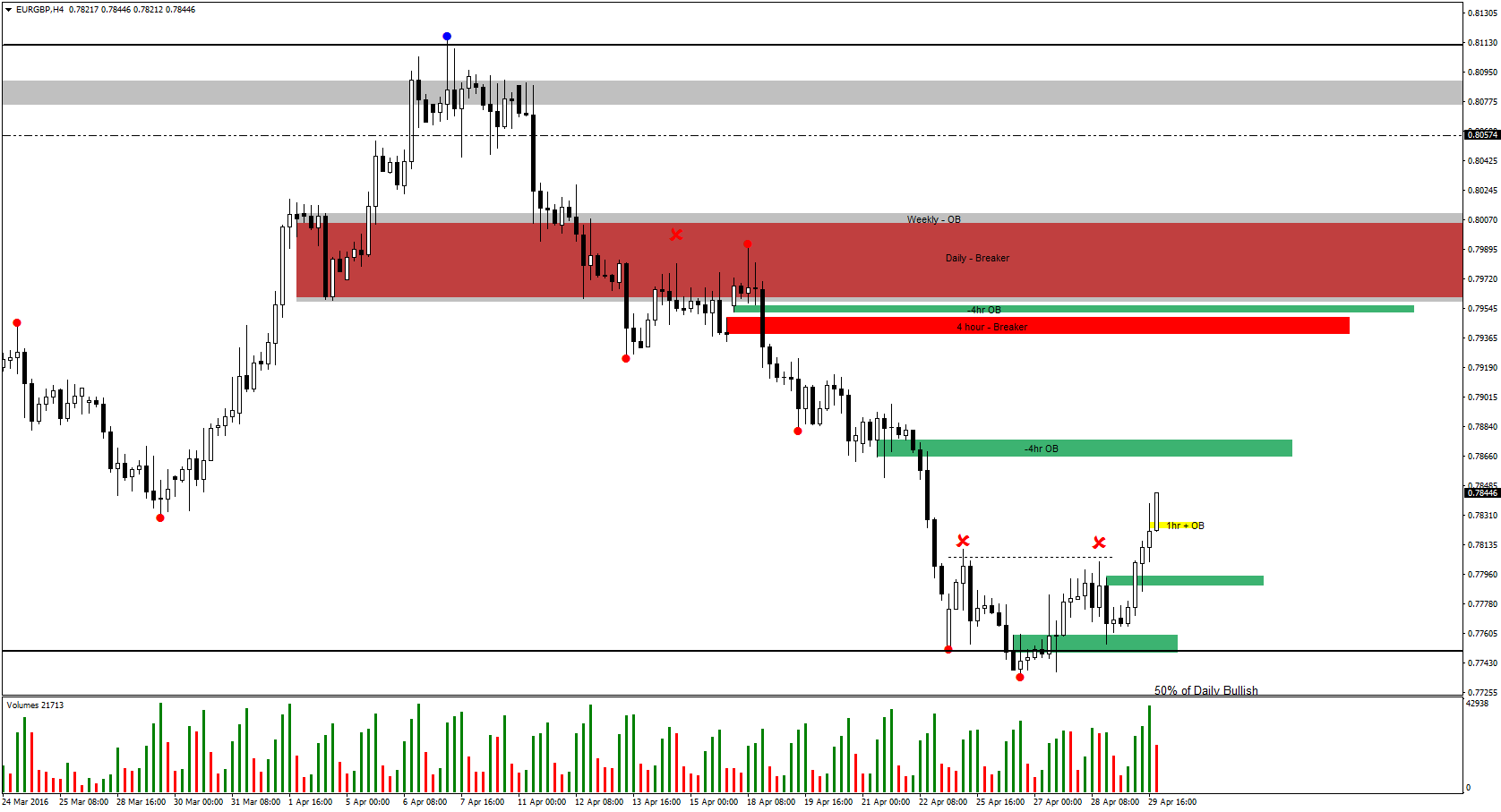

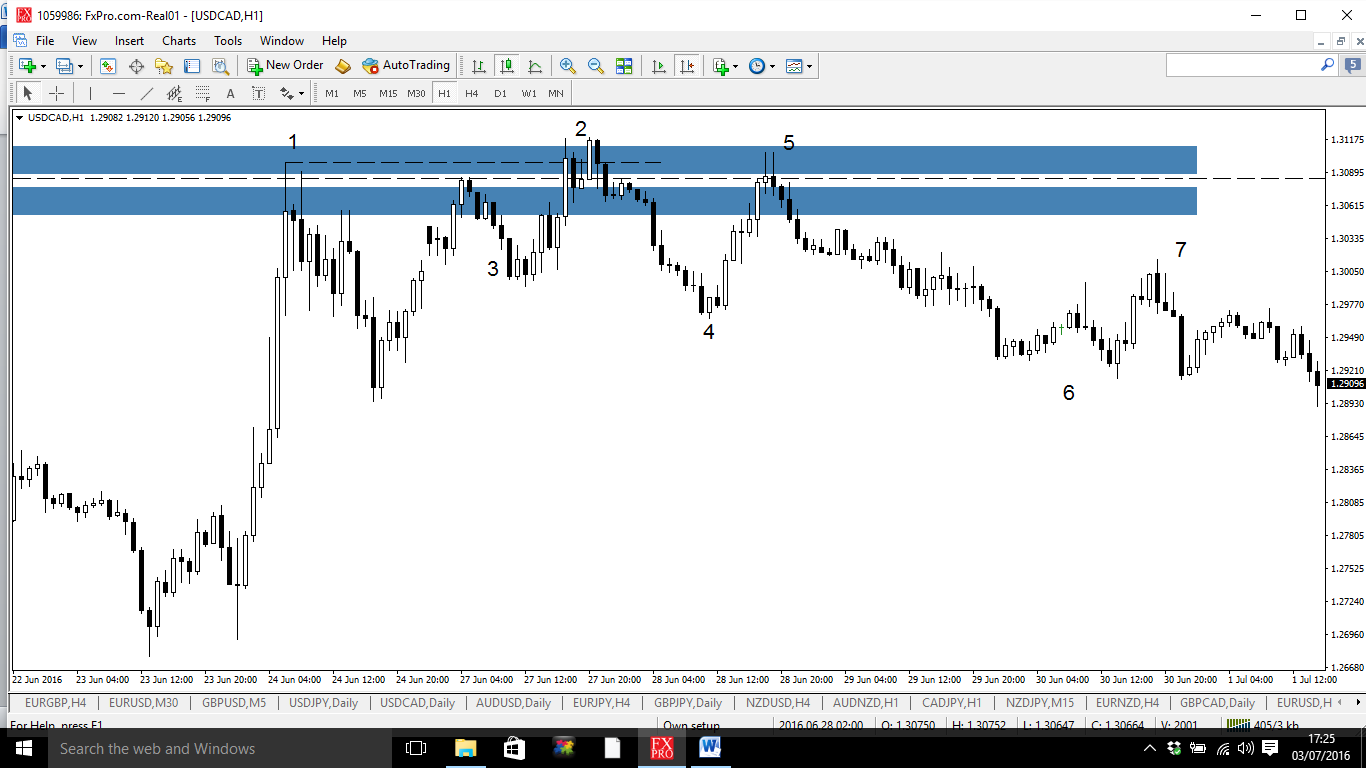

Below is a 1 hour chart. I have found there is 4-5 different things I feel like I need to see for this to be a valid trade.

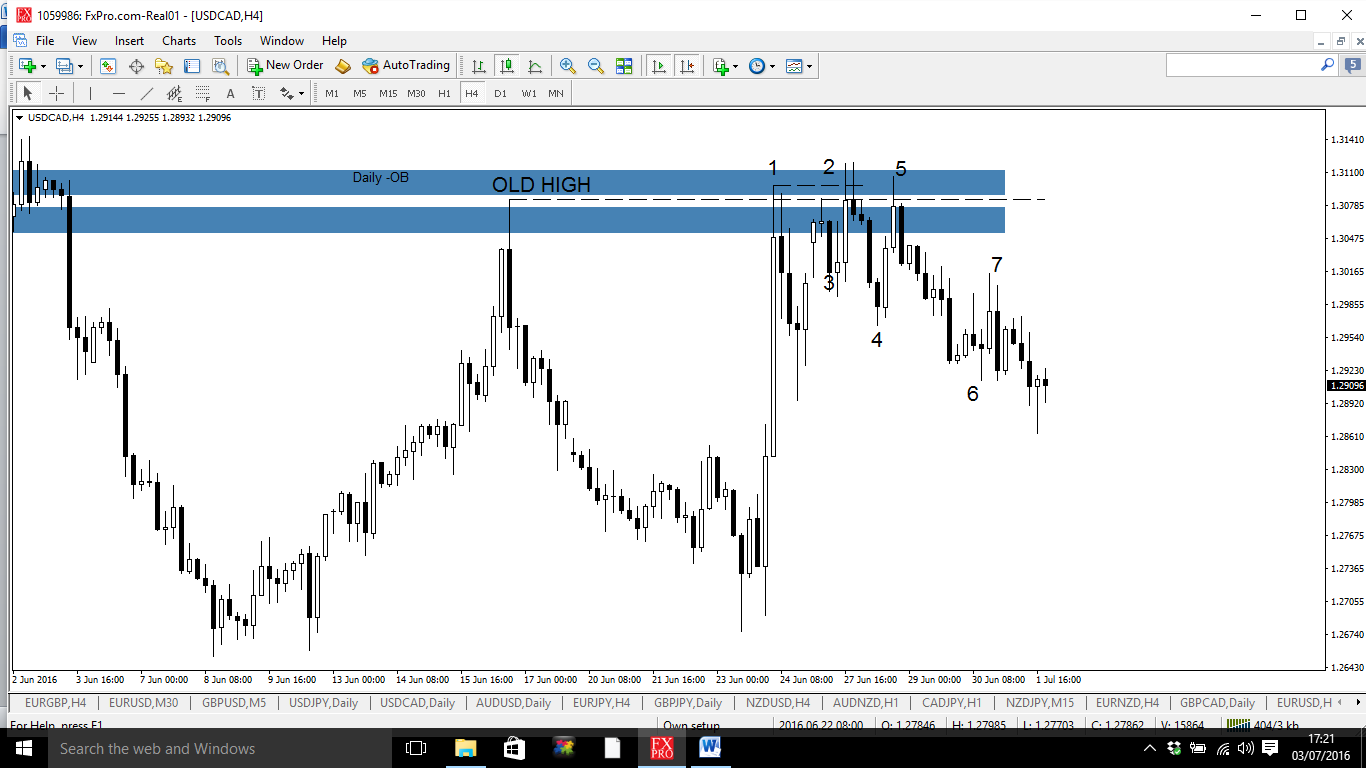

OLD HIGH –

A break above an old high and into an area such as a recent order block. ICT always says “Beyond stops into Order Blocks” is one of the highest probability trades you can take. In this case it was above an old high and into two old bearish order blocks so this is an area we should be watching for a smart money reversal. Below is showing that high.

Once this has occurred I like to then view this area in 1 hr format or when we get down to the fine tuning a 15 minute chart.

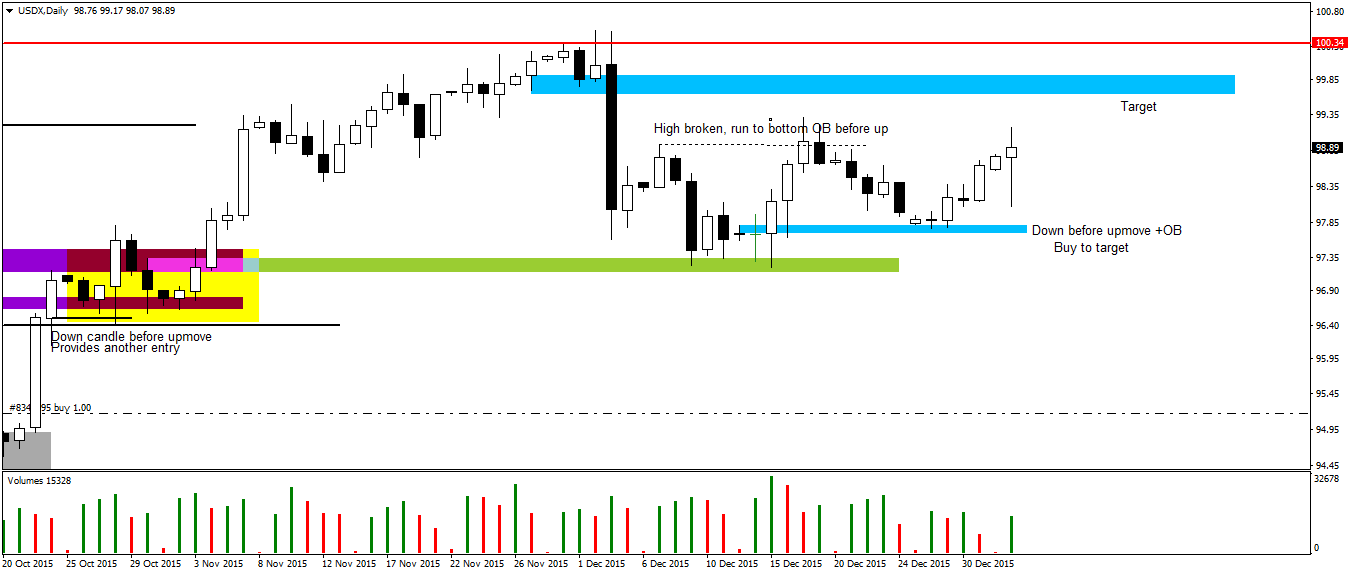

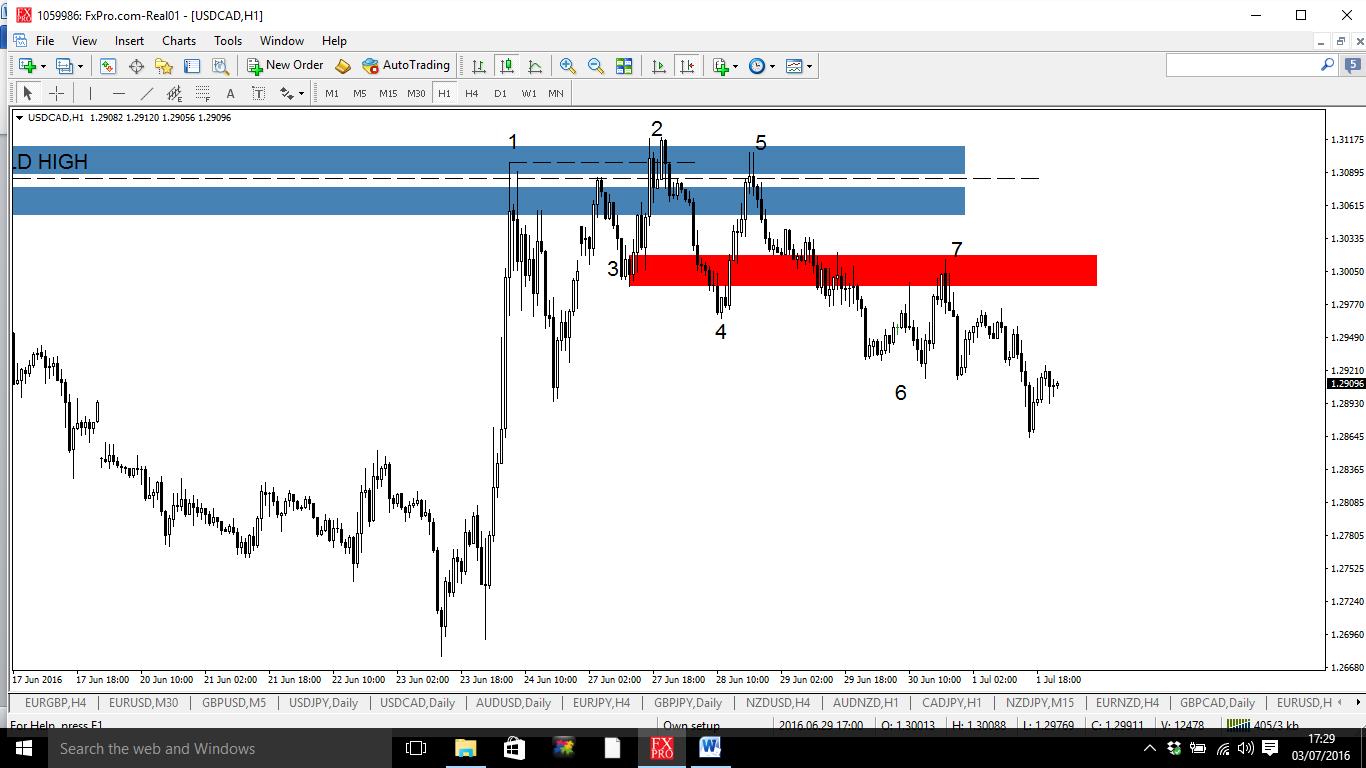

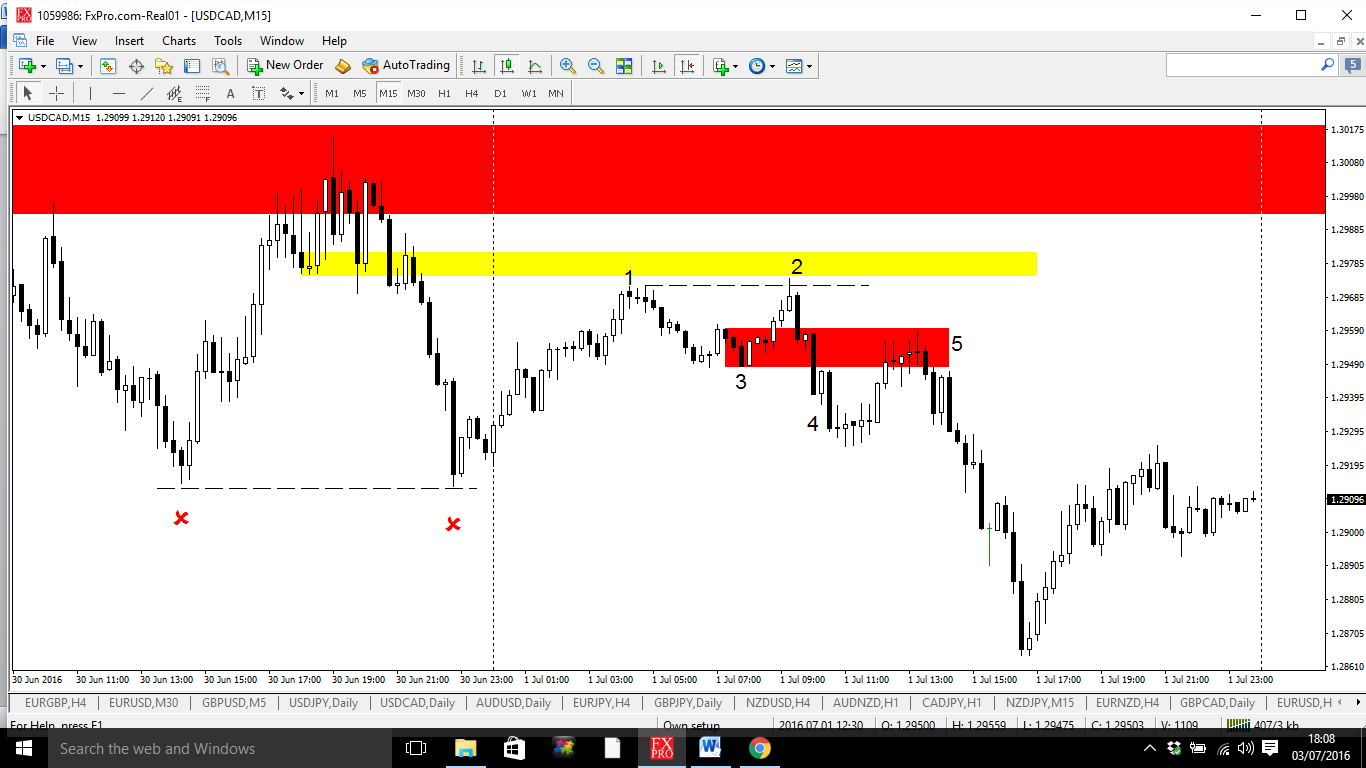

Below is our one hour chart and I have numbered all that I seem to be seeing with this breaker pattern time and time again.

- The break of the HTF high we just mentioned.

- A break of a short term high. At two we can see this has broke the high formed at 1.

- We then mark the down candle before the upmove that broke this high.

4. We see a break below the breaker candle (point 3). I see this as a break in market structure as the market gives a clue as to where it is going

5.Price trades up to test the old highs but does not break them. Respecting the bearish order block which was created at 2 is a good sign.

6.Prices pushes below and this time stays and creates several candle closes below our breaker.

7.Price runs up to 7 which is our entry.

My understanding of why this happens:

The break of the HTF high

Price is pushed above the high for liquidity. By pushing price above this level the smart money triggers any sellers who have been moving stops lower above previous highs. These stops are buy stops. This means smart money can sell large amounts into the buy stops with someone else on the other side to take their trades. It also goes unnoticed as they are selling into a lot of buying and can almost disguise what they are doing to the untrained eye. Also, by breaking the high, they attract more buyers who think price had broke out and is gunning for new highs. Again, more for them to sell into.

A break of a short term high and drop below (turtle soup)

Here I think the smart money invest in sending the money higher from the breaker candle again for retail traders to think the market is again on its way to make a higher high, catch stops and get people on the wrong side of the market.

The break below the breaker candle

This seems to be the tipping of its hat that it may be going lower. However I think it may be the result of the smart money selling just enough to edge the market lower before it allowing it to come right back up to test the turtle soup/newly formed high. Sometimes we see a run to test the highs, sometimes we don’t. This is one thing I need to research more. Maybe larger reversals need 2 visits or more, lower time frames don’t.

Not breaking the newly formed high

This makes complete sense. If Smart money had put on large sell positions at the now highest point, why would they let price go back above this area? If they let price come above this high they would risk the possibility of more money coming in on the buy side and taking price higher, totally scuppering their plan, or at the very least, meaning they have to put on larger positions that they had planned to. This is a key part for me and to see this area defended and price move away quickly is a good sign in my opinion. Also, is this where smart money adds the final load/rest of its position which enables them to get more on at the best possible price?

Price closing/running below breaker.

This obviously differs on different time frames but price seems to settle below for a period of time with less volatility.

Price running back to breaker

Price runs back to the breaker for entry. Again this makes sense because if they are going to send price lower, why would they want them open buy positions to go down with them and reduce profits/carry a loss if they don’t have to? Now they are on the right side of the market (the side they know they are taking price) they can offload them positions at the same point they put them on. Maybe offloading these positions and selling is the final transaction which tips the scales for the market to go lower? It seems like the breaker is used as some sort of elaborate holding tool which keeps everything even and settle whilst they re jig everything around. Then remove the final piece and everything falls into place.

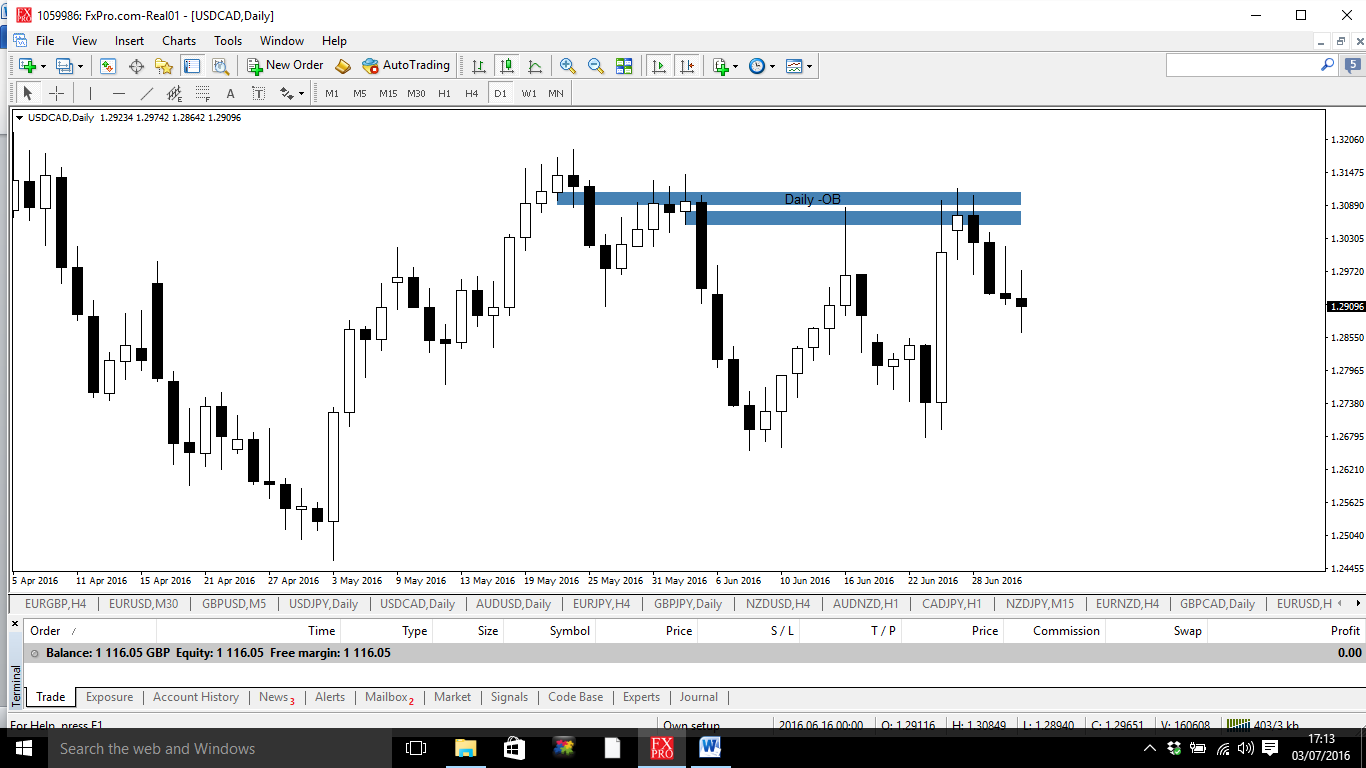

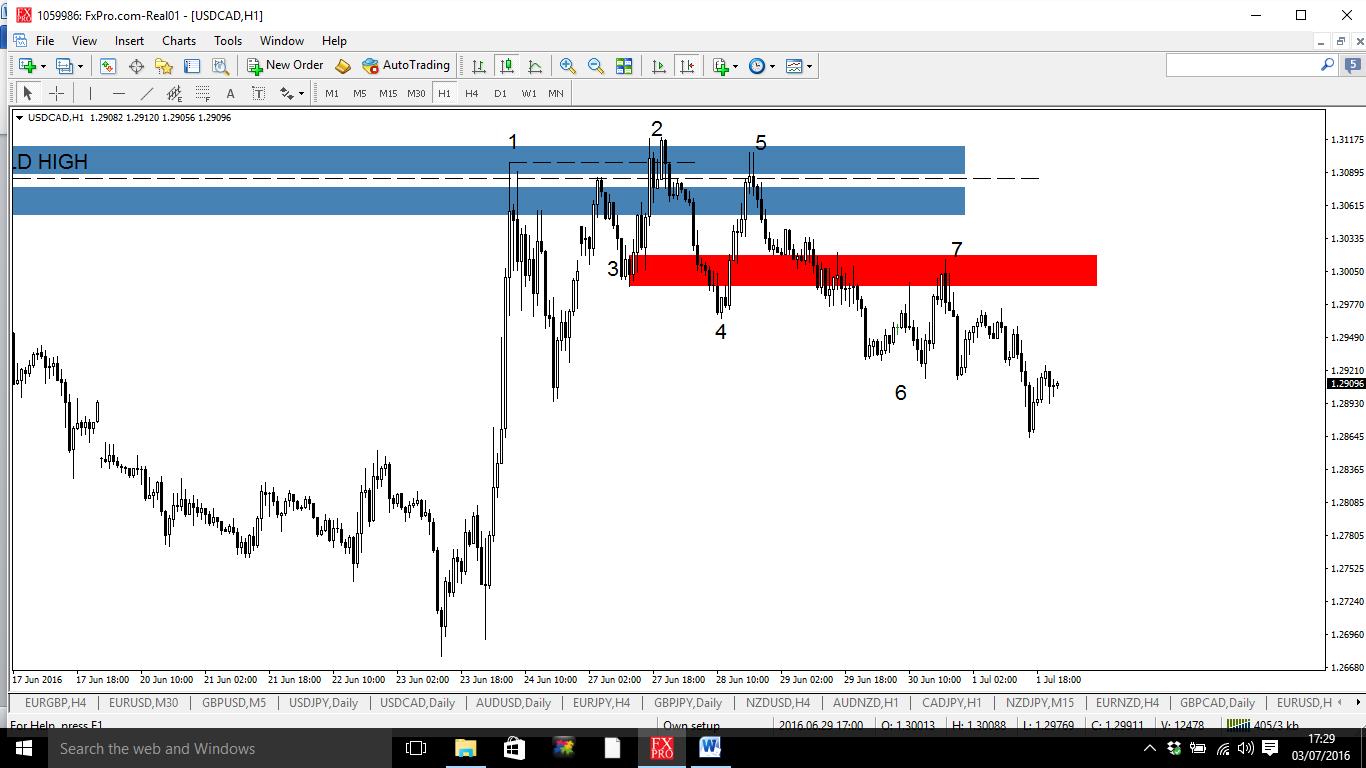

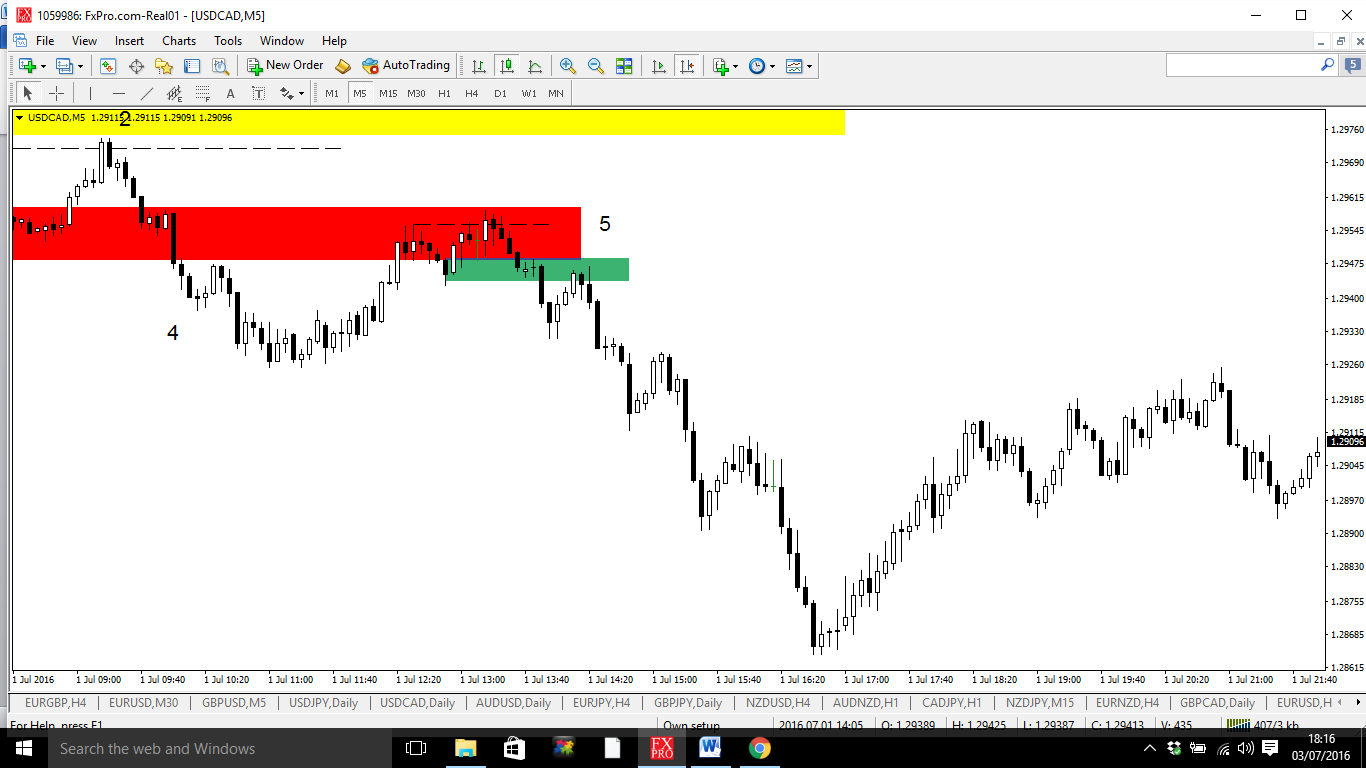

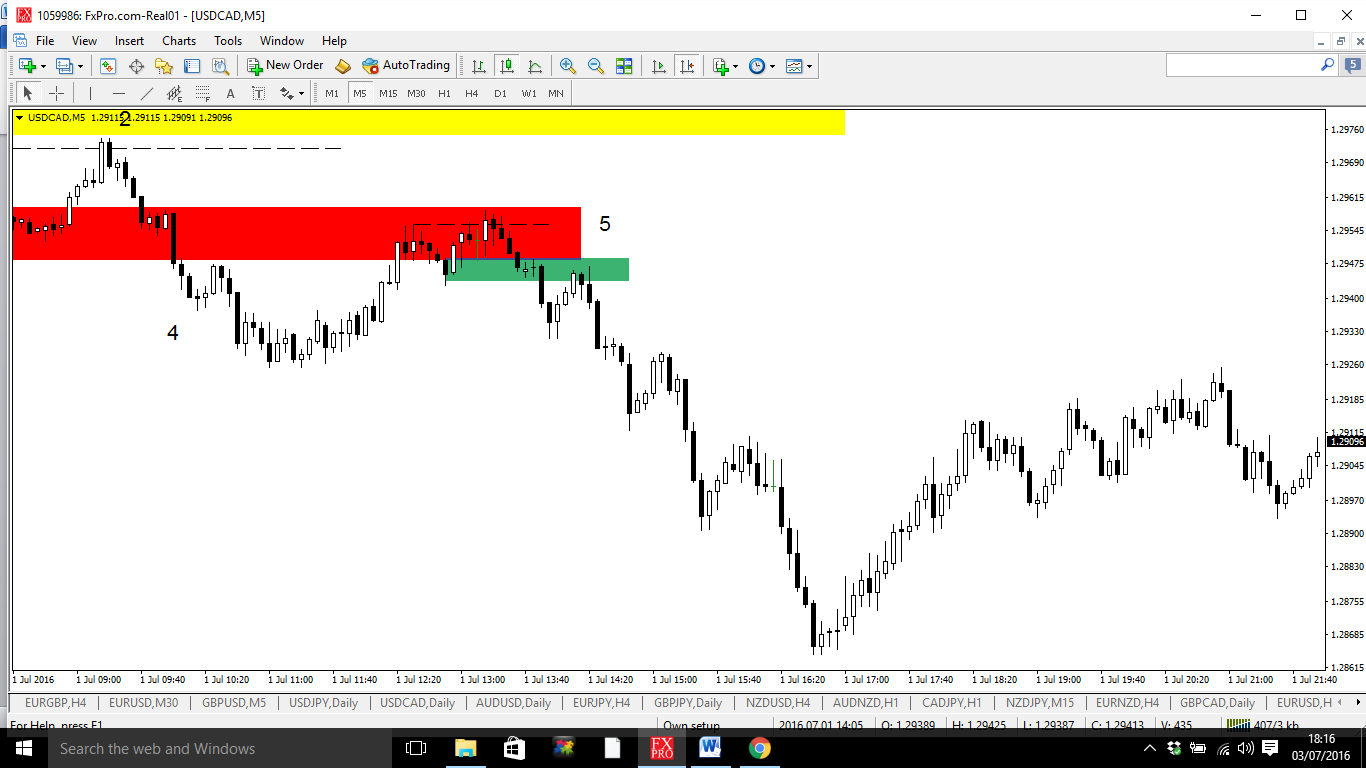

The trade I traded last Friday was in the same pair but on a lower time frame.

Here we have a 1 hour order block highlighted in yellow:

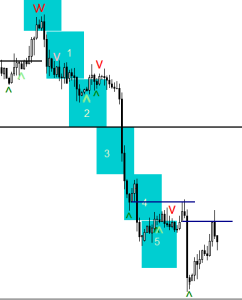

This is a continuation of the breaker entry from above. (Entry at 7 on chart). If you have missed that entry I think this is a good way to get back in at an area very close to our breaker entry.

Firstly, a positive is the fairly clean lows left and this is another thing in favour of the sell. This trade/breaker was missing the run up and test of the highs at 2 but maybe that was because there was a much more obvious run and staying below the lows at 4 rather than the ‘tip of the hat’ break in structure on the last example. Or maybe because most of their position was added on the 1hr/4hr reversal which was larger and only just recently engineered.

Anyway:

- A short term previous high is broken as price runs into a bearish order block.

- Price quickly rejects and breaks short term market structure of 3.

- We mark out the breaker candle

- Price closes and stays below the level

- Price runs up to and rejects off 5 which is our entry.

What I like about this is even if for some reason we were looking to go long it doesn’t meet the criteria for us to enter. For example 4 broke the lows at 3, but we didn’t see any of the other things happen so had no reason to consider entering long.

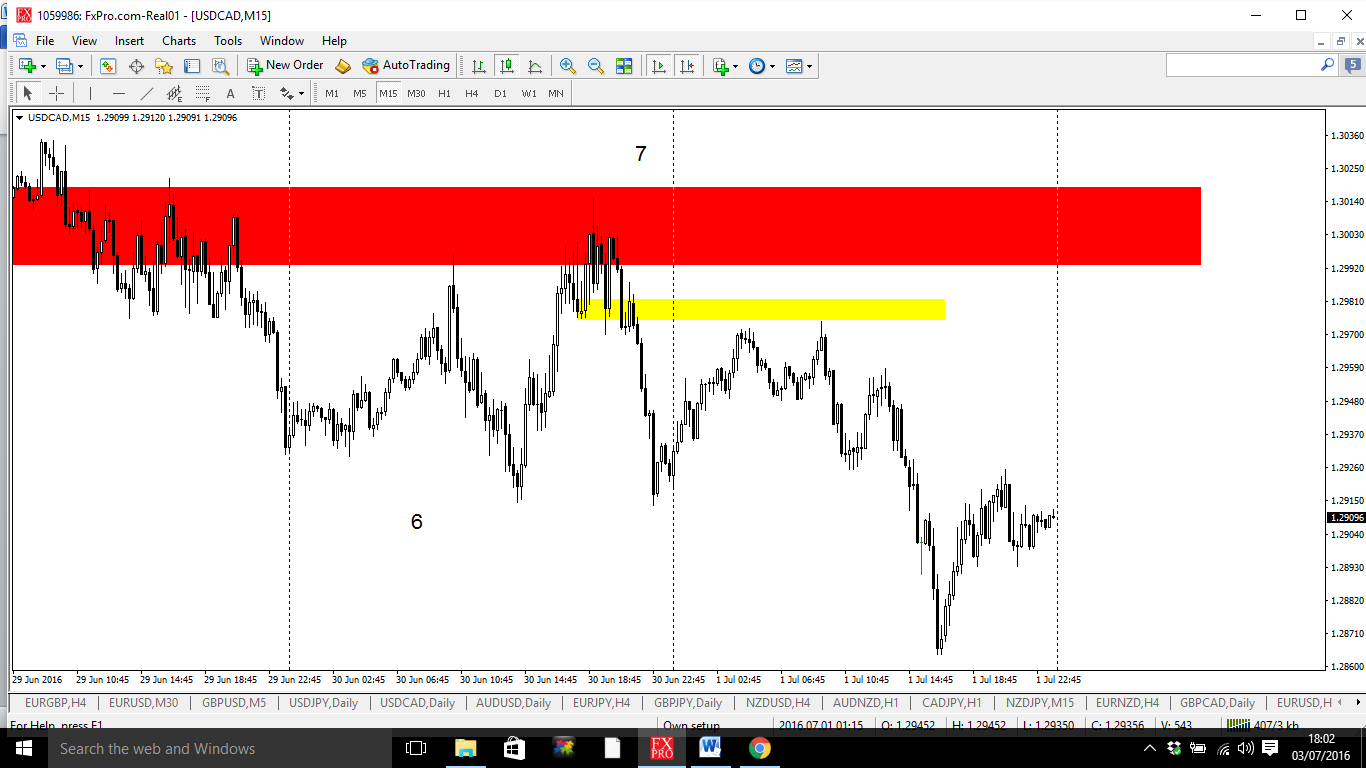

This is even greater because we can go to a 5 minute chart and see the same thing again within the 15 minute pattern.

Number 5 above was our entry from the 15 minute chart. Now in this area within our breaker zone we have a 5 minute model which does exactly the same thing. A short term high broken into one of our areas (order blocks, breaker, etc) , A run and stay below, a pop up to our 5 minute breaker (green rectangle), Our Entry.

Having followed several superb traders who use ICT’s work on twitter for the last month or two what I love about this trade entry is tight stops which takes the risk:reward ratio to a different level if you can be brave and trust what you are seeing.

The only thing I am wary of is testing the old highs which would stop me out if I enter a breaker without that first happening but I am sure with more experience and examples I will work that part out.

ICT said in a recent video about deciding what you are going to trade and you will see it in the right areas in line with institutional order flow whether it be turtle soups, order blocks or breakers.

What I am seeing is all 3 of them. A turtle soup, a break in market structure, a respecting of an order block, and a breaker. All of these happened in the area of a daily order block. All of these happened in the area of a 1 hour order block.